How To Recover After Bankruptcy

For the most part, bankruptcy should be the action of last resort when it comes to your money issues. However, there are times when bankruptcy really is the last option you have left. If you have experienced a long-term employment problem, or if you have had a medical problem that causes you financial distress, bankruptcy might be your last option. Once you have filed for bankruptcy, however, it doesn’t mean that it’s the end of your financial life…

Is A Zero Based Budget Right For You?

One of the budgeting techniques that has gained some popularity in recent years is the zero based budget. In this budget, you make sure that every dollar is accounted for at the beginning of the month. You look at what you expect to get in terms of a paycheck, and then use every penny to pay bills, or accomplish your goals. As part of your budget, you decide what will go to debt reduction, or to building an emergency fund, or to your retirement account. You can also put money toward a vacation or some other goal, on top of …

Should You Sell Unwanted Gifts?

Note: This is a post from Joan Otto, Man Vs. Debt community manager. Read more about Joan.One of our readers shared the following story and question with me, and gave me permission to share it here:I’m trying to downsize and get rid of my crap to pay off my debt. I also don’t like clutter so I want to get rid of my stuff so my family of 3 can comfortably fit into 1100 square feet. But my father-in-law is the king of crap, and gives us stuff we’ll never use and never need. I have 2 hammocks (and live in an apartment), a circular saw, tons of memorabilia from our …

4 Personal-Finance Lessons From NASCAR

Note: This is a post from Joan Otto, Man Vs. Debt community manager. Read more about Joan.For those of you who didn’t spend Sunday watching the Daytona 500 – and bemoaning its 6.5-hour rain delay and multiple 8-car-plus crashes – well… you have my sympathy. (And my apologies, because you probably aren’t going to like today’s post if you’re not a NASCAR fan!)I’ve been an auto-racing fan since high school. I grew up going to local dirt tracks, and a NASCAR race was the first professional sporting event…

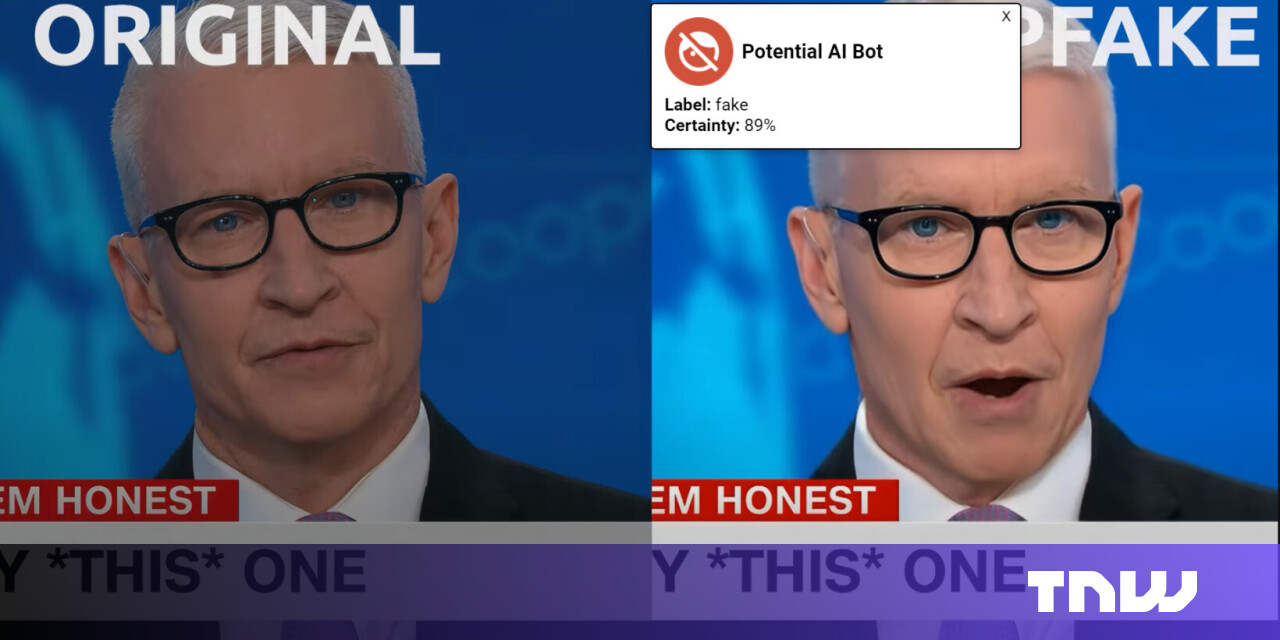

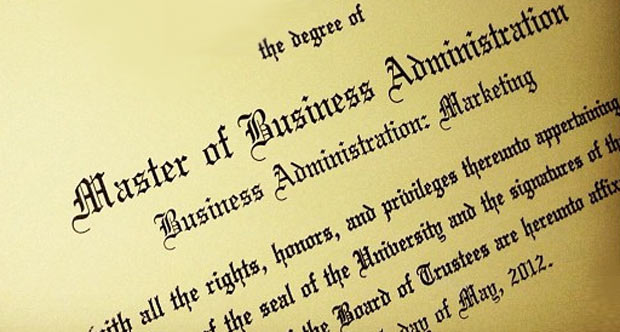

You Don’t Need That MBA Degree: Continuing Thoughts on Higher Education

This is a guest post by Mariana Zanetti, who earned her MBA degree from one of Europe’s top business schools and has more than 12 years of international marketing experience in three countries. She is the author of The MBA Bubble and shared this post in response to an earlier Man Vs. Debt post by Joan titled Do You Really Need That Master’s Degree? When my Harvard MBA colleague told me that I should pursue a “top” MBA program twelve years ago, I did not doubt it. “Don’t worry,” he said. …

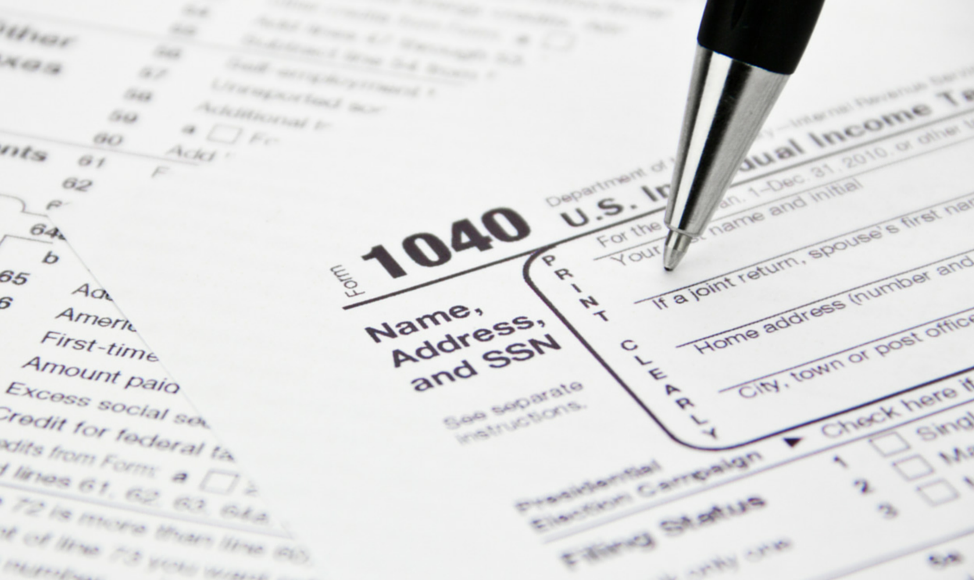

Taxing Decisions: Joan’s Mid-March Financial Update

Image courtesy of our friend PT of PT Money (www.ptmoney.com) Note: This is a post from Joan Otto, Man Vs. Debt community manager. Read more about Joan.Tax season is hitting full-force here in the US! Our taxes have been done since early February, thanks to my own OCD record-keeping and our accountant’s desire to get us in and out as early as possible each year, what with our 80 streams of income and all that.But after a couple years of paying in some hefty figures around this time of year thanks to self-employment taxes and some other strangeness, this year, we are getting refunds from both state …

The Great Pile of Unread Books

Note: This is a post from Joan Otto, Man Vs. Debt community manager. Read more about Joan.I love to read.It doesn’t really matter what it is – barring anything else handy, I’d happily read the back of a cereal box at breakfast – but since I was about 3 years old, I’ve rarely been without a pile of books in progress.In January, I set a goal on Goodreads to finish 75 books this year. I started out great – averaging almost a book a day.But life happens, and the books piled up into the stack you see above, unfinished and, in most cases, not even started!The mental drain of being “behind”Here’s the problem: I …

Julian’s Success Story: How Going $42,000 in Debt was the Greatest Decision I’ve Ever Made

Julian Hayes II is a fitness and lifestyle coach and writer based out of Nashville, Tennessee. He is the creator of 206 Fitness. Why 206? Not only is 206 one of his nicknames, but there are also 206 bones in the body. He believes anyone can achieve the body they’ve always wanted while still living a fun and adventurous life. Read more about him and download his free ebook on how to achieve the body you’ve always wanted while owning life at 206fitness.com and connect with him on Facebook & Twitter…

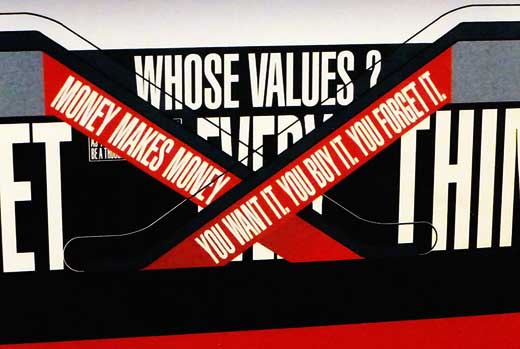

You Want It. You Buy It. You Forget It.

Note: This is a post from Joan Otto, Man Vs. Debt community manager. Read more about Joan.Two summers ago, while visiting an art museum in Washington, D.C., we came upon an exhibit in the process of being installed. Huge letters and swaths of red, black and white covered every square inch of wall and floor.When I saw it, I took the photo above, hoping it would serve as a reminder to go back and see the finished exhibit and revisit the phrases plastered throughout.WHOSE VALUES?FORGET EVERYTHING.YOU WANT IT. YOU BUY IT. YOU FORGET IT.And while I haven’t gotten back to see the final installation of Belief+Doubt (I hope to – …

Business and Hustling Lessons from the WWE Network

Note: This is a post from Joan Otto, Man Vs. Debt community manager. Read more about Joan.You guys are going to think I spend my Sunday afternoons watching America’s best not-exactly-a-sport sports, between today’s post and the one from last month about 4 Personal-Finance Lessons from NASCAR!I spent THIS Sunday watching… you guessed it… WrestleMania 30, thanks to my roommate’s subscription to the WWE Network, which I admit I watch with rather startling frequency.The funny part is, …

The Report from the Three-Year Mark: Joan’s Mid-April Financial Update

Note: This is a post from Joan Otto, Man Vs. Debt community manager. Read more about Joan.It’s official: I’ve been tracking my debt for exactly three years.While I didn’t post my first financial update on Man Vs. Debt until a year later, I first sat down and wrote my detailed list of debts – the one you see listed on my Joan’s Finances page – on April 14, 2011.Taking inventory and facing what …

Flipping My First House – 8 Weeks…and Continuing

My friend Joshua has decided to try his hand at flipping houses. He wanted to write about his house flip, and I wanted to learn from it, so I invited him to publish his experiences here. If you haven’t yet read the first two posts, I have provided the links below so you can catch up!Post 1: Flipping My First HousePost 2: Flipping My First House – 5 Weeks InThe Past 3 Weeks…Even the best laid plans sometimes don’t work out, but that is no reason to give up on them. I had the goal of finishing my flip house in eight weeks. That just simply isn’t going to happen. This doesn’t mean that my project is a failure, it just means …

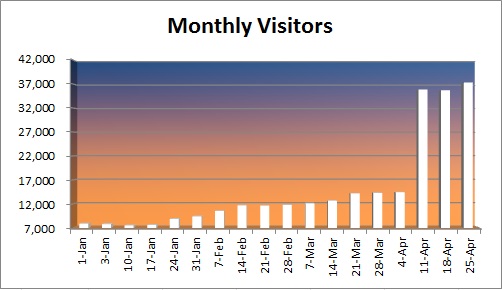

Still Growing in Popularity – Goals Update #17

Whew! It seems like every week is crazier than the last, and this past week has certainly been no different. I traveled to New York on a business trip a week and a half ago, and since then my article, “9 Things the Rich Do That the Poor Do Not” was picked up by Business Insider, and then because of it’s popularity was set up as a featured article on their site! All in all, that article had over 191,000 views and…

21 Things I Always Get From the Dollar Tree

Over the course of my adulthood, I have slowly discovered the amazingness of the dollar store. An item that typically costs $4 or $5 at another retail establishment might only cost $1 at the dollar store. After a few of these purchases, the savings could really add up! So why not just put a list together of the things we should be purchasing from the dollar store?Before I dive into my list of 21 things I always get from the Dollar Tree, I want to make a very important note. All dollar stores are not created equal. In addition to the Dollar Tree, you might…

Top 5 Reasons People Go Bankrupt And How to Avoid It

Many people struggle with managing their money. Sometimes, there just isn’t enough to go around. In fact, over 900,000 Americans filed for bankruptcy in 2014. You might think that those who file for bankruptcy are irresponsible spenders. That’s certainly some , but in reality many people are not excessive over-spenders. They’re simply unable to respond to unfortunate events.According to a 2010 study, the top 5 reasons why people file for bankruptcy are:Medical expenses (42{0e584ec94eaa64d073763ee1dc286a1f4d0f941424b1448bbfd01af7d90f9475})Job loss …

How to Become a Freelance Writer in 30 Days or Less (and Make $4,000 a Month)

I don’t often focus on the fact that I’m a freelance business writer, but that’s how I started my entrepreneurial career. I’ve since leveraged that into a business that brings in more money than my accounting day job used to. If you’re thinking of diving into the freelance writing space, or have recently started down that path, this is without a doubt a viable way to make a full-time living. Since learning how to become …

How to Be More Productive: The Best Tools for Creative Freelancers

After spending several years as a self-employed solopreneur myself, and working with a team of 3-4 people, we’ve tested out lots of different tools and apps to help streamline our business process. This has helped us learn how to be more productive as well as earn more money in less time. From managing our financial goals, to working with clients, to balancing everything on the go, our desire is to work smarter not harder. Likewise, your big goals probably include growing your online business, building a bigger and…

How to Budget With Irregular Income When You’re Self-Employed

I was recently a featured guest on the weekly Money Crashers Tweetchat (#mcchat), where the topic was all about Budgeting With Irregular Income. I regularly get questions related to this subject in my inbox, and on all my social media accounts. It’s something we all deal with as freelancers and business owners. It’s tough to balance finding new work, getting paid, and figuring out where your money should be spent. The worst part about having irregular income is that you never know …

Make Tax Season Less Painful: 5 Things to Reduce Stress

This is a sponsored post written by me on behalf of E*TRADE for IZEA. As always opinions are 100{0e584ec94eaa64d073763ee1dc286a1f4d0f941424b1448bbfd01af7d90f9475} mine and never influenced by any brand. Tax season is a topic we love to hate. Nothing feels worse than working hard all year long only to end up with several hours of tax prep, followed by a large tax bill. As business owners our taxes aren’t quite as simple as they used to be when we were employees with a W-2 from our jobs. Our business and knowledge of success continues to grow and because of this we’ve become investors too (even if we’re in the beginning stages). We see the importance of investing in…

Quarterly Income Report: How I Made $17,655 From Blogging (Q1)

At the beginning of 2015 I made a decision to focus less on client work and more on turning my blog into a sustainable business. After months of dealing with inconsistent income and taking on a bit of business debt, I decided I needed to take back control of my income by leveraging this blog. Mind you that I didn’t say “pimp out this blog” which is what a lot of freelancers do in order to make a living online. I’ve carefully crafted this platform over the …

What Happens if You Miss the Tax Return Deadline?

This post is part of the TaxACT #BeatTheDeadline blog tour which shares tips on how to make tax time a smooth and easy process before the April 15 deadline. TaxACT provides the tools and guidance to help you confidently file taxes easy and fast. Do your own taxes today at TaxACT. You got this. The tax return deadline is quickly approaching, so if you haven’t filed your taxes yet, you still have a bit of time (but not much!). I’m basically reminding myself of this because I still haven’t filed my taxes yet. Gasp! I know right?! The main reason I haven’t filed yet isn’t for…

How to Quit Your Job Without Burning Bridges

This post is from new Careful Cents contributor Kayla, who owns the blog ShoeaholicNoMore. Over the next six months she’s sharing journey to quitting her job and taking the leap into self-employment. Resigning from my very secure, but very boring, full-time job is something I’ve been thinking about constantly for the past few months, ever since I started freelancing online in July 2014. But before I talk about how to quit your job with grace and not burn bridges, let me back up a little bit and introduce myself. I’m Kayla, a full-time credit analyst at an agricultural lender in rural Kansas, a part-…

How to Choose the Best Business Checking Account as a Freelancer

As a self-employed freelancer, most of my financial business is done online or with mobile apps. But choosing the best business checking account can be daunting. Plus, you want to make sure you don’t spend extra money on fees. I’ve seen the benefits of technology and how going digital makes me more productive and streamlines my life. Oddly enough though, many consumers and small business owners (about half) still bank at traditional banks! It’s time you embrace technology and the benefits it offers, by finding the best business checking account. Some solopreneurs …

How to Find Affordable Health Insurance When You’re Self-Employed

So you missed the health insurance deadline and had to pay a penalty on your tax return? Don’t worry, you still have options — some of which are actually affordable. If you’re like me, you are probably procrastinating on applying for health insurance because you just don’t think you can afford the $400+ premiums per month. (Depending on your state and whether or not you’re single or married, your premium may be more or …