How We’re Handling A Sudden Loss Of Income

In the United States many individuals are currently out of work because the government considers their job or business non-essential, or impossible to carry out while maintaining social distancing. My husband works for a local university and has been home…

Pros and Cons of Car Title Loans

Car title loans are a convenient way to borrow money quickly. They provide a lump sum of cash based on the value of your vehicle, and you can use it for whatever financial need you may have. Car title debt…

How to Negotiate Dental Costs (2023 update)

Let me be blunt about negotiating dental costs. I’m no master negotiator. Of course, the title of this essay isn’t “Negotiation Tips for Masters”! Over the last few years though, I have slowly picked up a few tips and tricks…

Keeping Your Financial Information Secure Online

With the rise of online banking, it’s important to ensure the security of your financial accounts. Online banking offers many benefits, including convenience, flexibility, and access to a wider range of financial services. However, it also exposes you to the…

Watch Out for Interest-Only Home Loans

Now that the economy has picked up some, the housing market is recovering a little, and memories of the financial crisis are fading, some lenders are re-introducing a few “creative” financing methods. It’s possible to get an interest-only mortgage again, or get a loan with a low, low rate at the beginning. An interest-only loan is tempting because the borrower only pays the interest each month. This state of affairs can last from five to 10 years. When you only pay …

Why I’d Rather Pay $10,000 to Unload My House Than Become a Landlord

There are people out there who are made to be landlords. They like the idea of having someone else pay the mortgage on a home or apartment building and enjoying the ability to build equity on the property without using their own money. Once the property is paid off, the monthly rent is income (offset by the cost of taxes, insurance, and keeping the property up). I totally get why some people love the idea of getting into real estate and renting out property. I even get why many people who, upon moving, decide that they would rather rent out the old home than sell it. I am not one of those people. I am getting ready to move across the country, and…

What Do You Do With Your Savings?

One of the basic pieces of advice that we are often given about money is to save more. But where do you put that money? And what should you do with it? Create Goals for Your Savings While saving money just to save money does make sense in some ways, the reality is that few of us are willing to keep doing something “just because.” As a result, it makes sense to carefully consider your desired outcomes and figure out what you hope to accomplish with the money you are saving. First off, really think about what you hope to have happen…

Who Do You Trust For Money Advice?

For many of us, it’s difficult to know what to do when it comes to our finances. There are so many decisions to make. While the basic “live within your means” advice can apply, the reality is that there is more to money management than making sure that your expenses are smaller than your income. What do you do to save for retirement? What’s the best course of action when trying to pay down debt? There’s a lot to think about, and it makes sense to carefully consider who you will trust for money advice. Who Can You Turn To? One of the …

3 Signs You Need Help with Your Debt

One of the most difficult issues to overcome is debt. If you have a lot of debt, it can be difficult to move forward with your finances. The interest payments suck away your disposable income, and once you are stuck in the cycle, it can take serious effort to get out. In some cases, you might even need help dealing with your debt. You can get help from a legitimate counselor with the National Foundation for Credit Counseling, or get help from a fee-only financial planner. Here are 3 signs that you might need to seek professional help with your debt: 1. You Only Have Enough for Minimum Payments When you only have…

How To Avoid Falling Into A Bad Credit Score

Building good credit is a years-long process, while destroying credit only takes a few bad decisions. With this in mind, it’s important for new credit users to avoid the many mistakes which lead to bad credit scores. Too often it seems inexperienced credit cardholders underestimate the ease through which bad credit can be acquired. For these folks – the young ones especially – we thought it necessary to highlight the five best ways to avoid a bad credit score: Maintain A Healthy Debt-To-Income Ratio Credit score criteria includes something called the debt-to-income ratio. Basically it’s all your monthly debt payments added up and compared to your gross monthly income. If the …

Ways To Pay For College Without Breaking The Bank

Going to college can be stressful in so many ways. If you are just getting out of high school, you are being pushed into the real world on your own. Your responsibilities just increased ten-fold. You now have to get yourself to class everyday, do your homework, study for tests, and maybe even work. As if that is not enough, you also have to worry about how you are going to pay for college. If you don’t have money saved up to pay for tuition, you are basically on your own trying to find out how to pay for it. Luckily, you have quite a few options. College is far from cheap, but if you are wise you can pay for it without …

How To Recover After Bankruptcy

For the most part, bankruptcy should be the action of last resort when it comes to your money issues. However, there are times when bankruptcy really is the last option you have left. If you have experienced a long-term employment problem, or if you have had a medical problem that causes you financial distress, bankruptcy might be your last option. Once you have filed for bankruptcy, however, it doesn’t mean that it’s the end of your financial life…

Is A Zero Based Budget Right For You?

One of the budgeting techniques that has gained some popularity in recent years is the zero based budget. In this budget, you make sure that every dollar is accounted for at the beginning of the month. You look at what you expect to get in terms of a paycheck, and then use every penny to pay bills, or accomplish your goals. As part of your budget, you decide what will go to debt reduction, or to building an emergency fund, or to your retirement account. You can also put money toward a vacation or some other goal, on top of …

Should You Sell Unwanted Gifts?

Note: This is a post from Joan Otto, Man Vs. Debt community manager. Read more about Joan.One of our readers shared the following story and question with me, and gave me permission to share it here:I’m trying to downsize and get rid of my crap to pay off my debt. I also don’t like clutter so I want to get rid of my stuff so my family of 3 can comfortably fit into 1100 square feet. But my father-in-law is the king of crap, and gives us stuff we’ll never use and never need. I have 2 hammocks (and live in an apartment), a circular saw, tons of memorabilia from our …

4 Personal-Finance Lessons From NASCAR

Note: This is a post from Joan Otto, Man Vs. Debt community manager. Read more about Joan.For those of you who didn’t spend Sunday watching the Daytona 500 – and bemoaning its 6.5-hour rain delay and multiple 8-car-plus crashes – well… you have my sympathy. (And my apologies, because you probably aren’t going to like today’s post if you’re not a NASCAR fan!)I’ve been an auto-racing fan since high school. I grew up going to local dirt tracks, and a NASCAR race was the first professional sporting event…

You Don’t Need That MBA Degree: Continuing Thoughts on Higher Education

This is a guest post by Mariana Zanetti, who earned her MBA degree from one of Europe’s top business schools and has more than 12 years of international marketing experience in three countries. She is the author of The MBA Bubble and shared this post in response to an earlier Man Vs. Debt post by Joan titled Do You Really Need That Master’s Degree? When my Harvard MBA colleague told me that I should pursue a “top” MBA program twelve years ago, I did not doubt it. “Don’t worry,” he said. …

Taxing Decisions: Joan’s Mid-March Financial Update

Image courtesy of our friend PT of PT Money (www.ptmoney.com) Note: This is a post from Joan Otto, Man Vs. Debt community manager. Read more about Joan.Tax season is hitting full-force here in the US! Our taxes have been done since early February, thanks to my own OCD record-keeping and our accountant’s desire to get us in and out as early as possible each year, what with our 80 streams of income and all that.But after a couple years of paying in some hefty figures around this time of year thanks to self-employment taxes and some other strangeness, this year, we are getting refunds from both state …

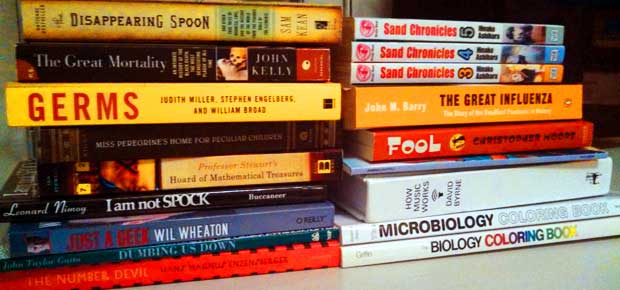

The Great Pile of Unread Books

Note: This is a post from Joan Otto, Man Vs. Debt community manager. Read more about Joan.I love to read.It doesn’t really matter what it is – barring anything else handy, I’d happily read the back of a cereal box at breakfast – but since I was about 3 years old, I’ve rarely been without a pile of books in progress.In January, I set a goal on Goodreads to finish 75 books this year. I started out great – averaging almost a book a day.But life happens, and the books piled up into the stack you see above, unfinished and, in most cases, not even started!The mental drain of being “behind”Here’s the problem: I …

Julian’s Success Story: How Going $42,000 in Debt was the Greatest Decision I’ve Ever Made

Julian Hayes II is a fitness and lifestyle coach and writer based out of Nashville, Tennessee. He is the creator of 206 Fitness. Why 206? Not only is 206 one of his nicknames, but there are also 206 bones in the body. He believes anyone can achieve the body they’ve always wanted while still living a fun and adventurous life. Read more about him and download his free ebook on how to achieve the body you’ve always wanted while owning life at 206fitness.com and connect with him on Facebook & Twitter…

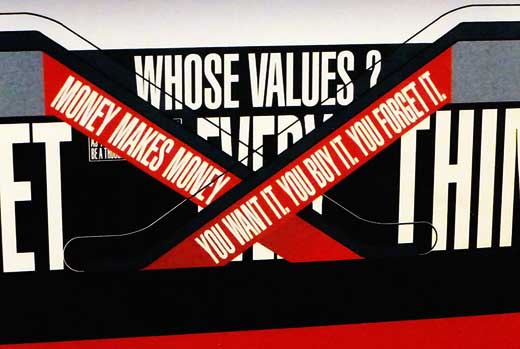

You Want It. You Buy It. You Forget It.

Note: This is a post from Joan Otto, Man Vs. Debt community manager. Read more about Joan.Two summers ago, while visiting an art museum in Washington, D.C., we came upon an exhibit in the process of being installed. Huge letters and swaths of red, black and white covered every square inch of wall and floor.When I saw it, I took the photo above, hoping it would serve as a reminder to go back and see the finished exhibit and revisit the phrases plastered throughout.WHOSE VALUES?FORGET EVERYTHING.YOU WANT IT. YOU BUY IT. YOU FORGET IT.And while I haven’t gotten back to see the final installation of Belief+Doubt (I hope to – …

Business and Hustling Lessons from the WWE Network

Note: This is a post from Joan Otto, Man Vs. Debt community manager. Read more about Joan.You guys are going to think I spend my Sunday afternoons watching America’s best not-exactly-a-sport sports, between today’s post and the one from last month about 4 Personal-Finance Lessons from NASCAR!I spent THIS Sunday watching… you guessed it… WrestleMania 30, thanks to my roommate’s subscription to the WWE Network, which I admit I watch with rather startling frequency.The funny part is, …

The Report from the Three-Year Mark: Joan’s Mid-April Financial Update

Note: This is a post from Joan Otto, Man Vs. Debt community manager. Read more about Joan.It’s official: I’ve been tracking my debt for exactly three years.While I didn’t post my first financial update on Man Vs. Debt until a year later, I first sat down and wrote my detailed list of debts – the one you see listed on my Joan’s Finances page – on April 14, 2011.Taking inventory and facing what …

Flipping My First House – 8 Weeks…and Continuing

My friend Joshua has decided to try his hand at flipping houses. He wanted to write about his house flip, and I wanted to learn from it, so I invited him to publish his experiences here. If you haven’t yet read the first two posts, I have provided the links below so you can catch up!Post 1: Flipping My First HousePost 2: Flipping My First House – 5 Weeks InThe Past 3 Weeks…Even the best laid plans sometimes don’t work out, but that is no reason to give up on them. I had the goal of finishing my flip house in eight weeks. That just simply isn’t going to happen. This doesn’t mean that my project is a failure, it just means …

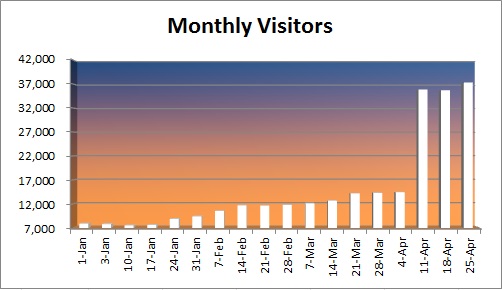

Still Growing in Popularity – Goals Update #17

Whew! It seems like every week is crazier than the last, and this past week has certainly been no different. I traveled to New York on a business trip a week and a half ago, and since then my article, “9 Things the Rich Do That the Poor Do Not” was picked up by Business Insider, and then because of it’s popularity was set up as a featured article on their site! All in all, that article had over 191,000 views and…