How Could You Make An Extra $200 This Week?

[share_sc] Note: This is a post from Joan Concilio, Man Vs. Debt community manager. Read more about Joan here. This post may contain affiliate links that help support this website. At one point not too long ago, I had one…

Make a Grocery Plan in 2024 that Works for Your Family

I have personally felt the effects of higher inflation on my grocery bill. I’m writing this post at 11:30 p.m. on Sunday night, and Chris and I have just gotten back from a 2.5-hour trip to the grocery store. Everything’s…

Top 7 Accessories To Enhance Your Land Rover Defender

Image source Adventurers and outdoor lovers all around the world are enthralled with the Land Rover Defender, an iconic representation of tough resilience and off-road abilities. Although the Defender’s original setup is remarkable, its performance, usefulness, and visual appeal can…

Understanding Your Annual Income: A Guide to Using Our Yearly Wage Calculator

You’ve earned it, so shouldn’t you understand it? The comprehension of your annual income is more than just knowing your salary. The yearly wage calculator lets you assess your gross income, combining various income sources such as bonuses, overtime pay,…

5 Ways to Be More Responsible When Investing in Cryptocurrencies

This article is for informational purposes and should not be construed as financial or legal advice. Cryptocurrencies are often seen as tech-savvy and adventurous, but there are many compelling reasons why investing in them would be a good idea. We’ve…

Budget-Friendly Tools to Boost Remote Employee Productivity

In today’s evolving work landscape, working remotely has become more common. Approximately 22 million employed adults in the United States, aged 18 and over, work from home full-time, comprising approximately 14% of all employed adults. This translates to an increased…

5 Ways to Maximize the Use of Extension Cord

Extension cords can come in handy by providing access to electrical outlets wherever needed around the house, yard, or office. They offer flexible and temporary access to power. However, the most critical nature lies in the safe selection and use…

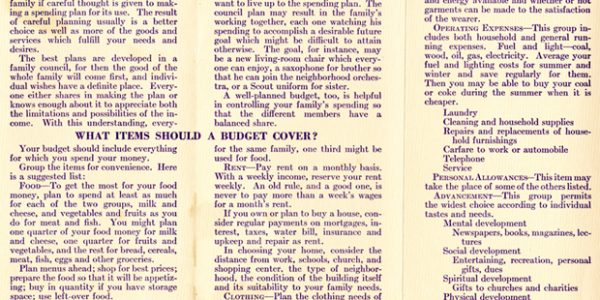

Money Management for the Family: Some TRULY Timeless Tips (2024 Update)

[share_sc] Note: This is a post from Joan Concilio, Man Vs. Debt community manager. Read more about Joan. A couple of months ago, Chris and I were browsing in a local antique store and he picked something up and said, “Hey, Joan,…

The Top 5 Benefits Of Recreational Therapy

People coping with emotional, mental, or physical health challenges might find great relief via recreational therapy. Skill restoration, mood enhancement, quality of life enhancement, and social connection strengthening are all possible outcomes of recreational therapy. Finding and working with a…

3 Top Blogs To Find Pickleball Paddle Discount Codes

When I learned how to play pickleball, I scoured the internet for all the information I could find about pickleball paddles, including what paddles where USPA approved or what material the paddles were made of. I decided to purchase a…

Why You Should Tackle Overwhelming Debt Sooner Than Later

Debt is a challenging issue. You can only stretch your finances so far, and while credit may be a short-term solution for you to make ends meet, it always catches you in the long run. If you want to end…

The Minimalist’s Guide to Managing Large Expenses Without Going Into Debt

In the modern-day consumerist society, practicing finance using minimalistic approaches takes a lot of work. Minimalism involves owning fewer things; it is also a proactive approach to money, where simplicity and purpose are essential. Enormous, unanticipated costs like hospital charges,…

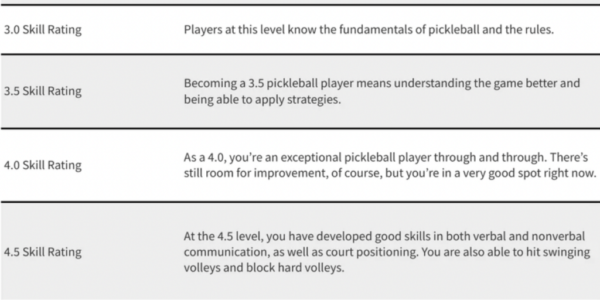

How does DUPR Rating Work?

DUPR, which stands for Dynamic Universal Pickleball Rating, serves as the yardstick for measuring your skill level in pickleball. It’s akin to a report card for players, offering insights into their proficiency and progress over time. The Scale: From Novice…

How To Pay Off Debt and Build Savings Simultaneously

Image by Fabian Blank on Unsplash A Bankrate study reveals that 36% of Americans have more credit card debts than savings. Emergency savings remain a significant worry for most consumers, with over half of them feeling uneasy about the amount…

Dive into Blower Door Test

When dealing with construction and repair on living or industrial premises, it’s important to prevent the interaction of external and internal climates. This requirement stands as a crucial point for arranging a cost-effective space since not only comfort but also…

4 Crucial Components To Know

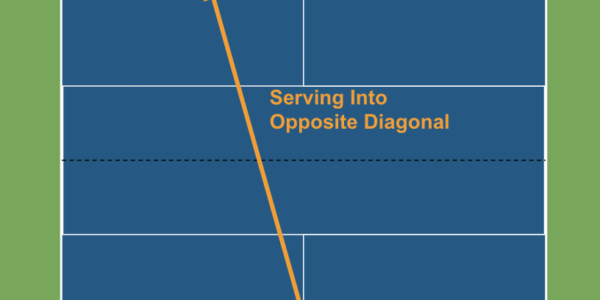

When I started playing pickleball, I couldn’t find a resource that describes how to play pickleball in addition to resources where you can find gear, courts, and community. As such, I put together this resource to help you when you…

Innovative Financing Solutions for Startups

Source: Every day, we see many intriguing startups making the news. However, a majority of startups don’t survive for long enough to make it to the news because of financial constraints and limited growth. To be a successful startup, it…

What is Sandbagging in Pickleball?

Sandbagging in pickleball is when you portray yourself worse than you actually are to achieve a better result. This is often completed in tournament play because the stakes are higher, and you can receive a monetary outcome if you win….

Your Complete Auto Insurance Resource

It probably goes without saying that there are more cars than people in the world. For example, in 2022, Ontario was at the top of the list of Canadian provinces with the most registered vehicles: there were over 9.4 million….

Simple Ways to Protect Your Savings from Inflation

Protecting your investments against inflation can be difficult because the goal is to maintain their value over time, particularly in a climate where prices are always rising. But it can be quite hard to do so as we are facing…

Why Personal Loan Insurance Is Essential for Borrowers

From financing a dream trip to renovating your home, personal loans seem like an easy fix. But in the excitement of getting funds fast, it’s tempting to overlook details like personal loan insurance. This coverage plays a significant role in…

4 Tips for Protecting Your Assets From Lawsuits and Creditors

Asset protection is a financial planning component meant to safeguard your assets from lawsuits and creditors. It legally insulates your assets without having to engage in the unlawful practices of concealment, fraudulent transfers, and contempt. Legally protecting your assets also…

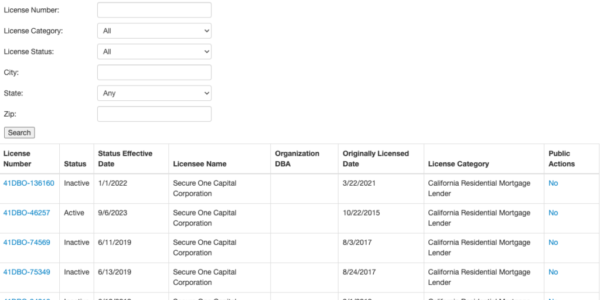

Secure One Financial: 3 Things You Need to Know

Did you receive a Secure One Financial mailer stating “You’re pre-approved for a personal loan…” with rates starting as low a 5.99%? Did you get the loan? Let’s look at what we found out about Secure One Financial, and whether…

What Is Income Investing? – Man vs Debt

Image Courtesy: Tima Miroshnicheko (Pexels) We’ve all got that one friend who has it made. He works a 9 to 5, but not because he’s struggling to make ends meet. He lives lean, putting the lion’s share of his income…