What’s Driving Performance During This Rally?

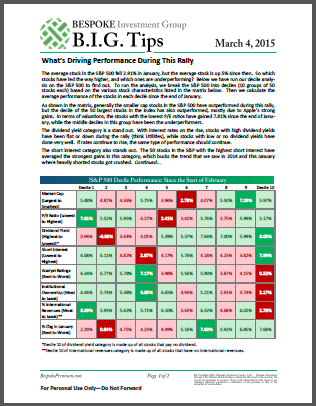

The average stock in the S&P 500 fell 2.91{0e584ec94eaa64d073763ee1dc286a1f4d0f941424b1448bbfd01af7d90f9475} in January, but the average stock is up 5{0e584ec94eaa64d073763ee1dc286a1f4d0f941424b1448bbfd01af7d90f9475} since then. So which stocks have led the way higher, and which ones are underperforming? Below we have run our decile analysis on the S&P 500 to find out. To run the analysis, we break the S&P 500 into deciles (10 groups of 50 stocks each) based on various stock characteristics like market cap, valuation, yield, short interest, institutional ownership, international revenue exposure…

Happy Birthday Bull?

On Monday, you’ll likely hear lots of talk about the 6th birthday of the current bull market that began on 3/9/09. But keep in mind that unless we make a new high on Monday, the bull market won’t actually be six years old. Right now the top of the bull market is the closing high from this past Monday (3/2), and the bull market won’t officially be six years old until it takes out those highs. One thing that is certain is that Monday will mark the six…

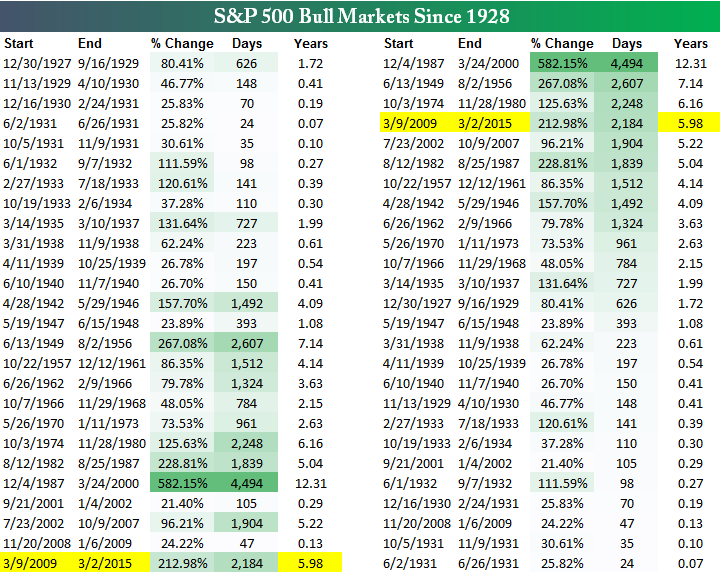

Historical Bull Markets for the S&P 500

In this week’s Bespoke Report, we published the table below ahead of Monday’s six-year anniversary of the S&P 500’s 3/9/09 bear market low. As we noted Friday, the bull market will have to celebrate its sixth birthday retroactively unless a new closing high is made on Monday. The generally accepted measure for a bull market is a rally of at least 20{0e584ec94eaa64d073763ee1dc286a1f4d0f941424b1448bbfd01af7d90f9475} that was preceded by a decline of at least 20{0e584ec94eaa64d073763ee1dc286a1f4d0f941424b1448bbfd01af7d90f9475} (based on closing prices). Using this calculation, below are two tables showing historical bull markets for the S&P 500 going back to 1928. The table on the left shows bull markets by date (oldest to most recent), while the table on the right shows bull markets by length (from longest…

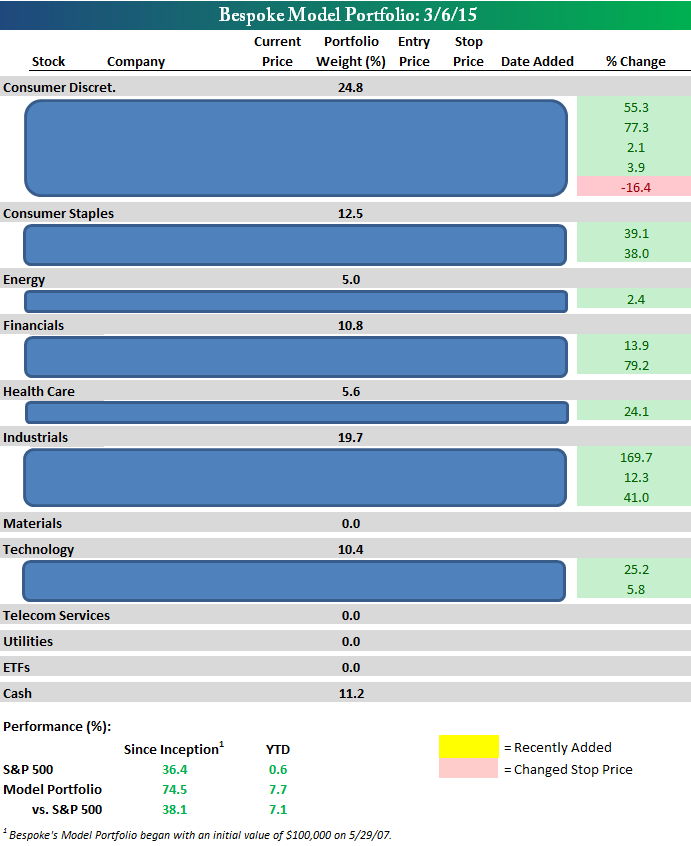

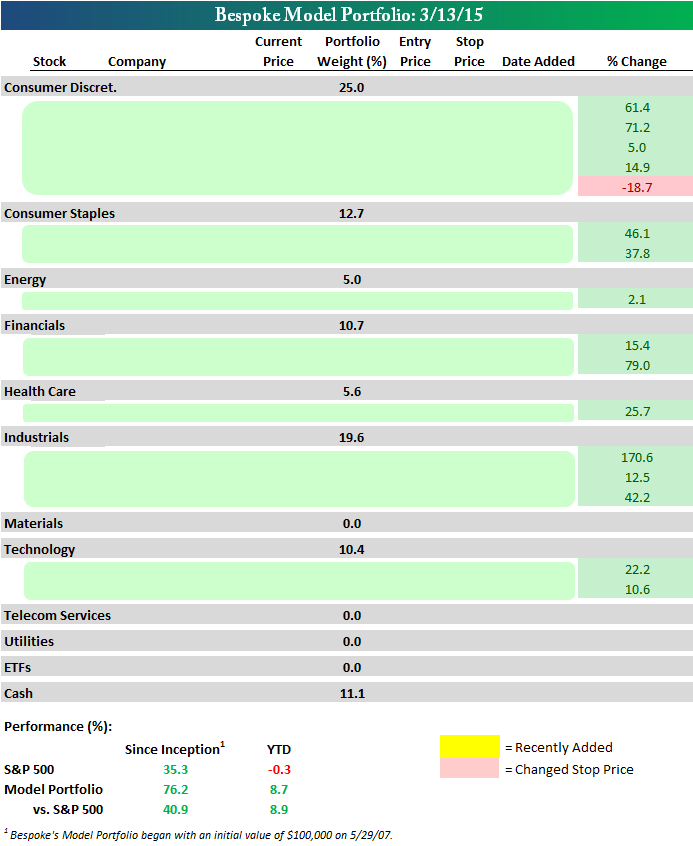

Bespoke’s Model Stock Portfolio

At the end of each week’s Bespoke Report newsletter, we publish an updated snapshot of our Bespoke Model Stock Portfolio. Below is a snapshot of the portfolio with sector weightings and performance numbers included, but the individual stocks are blocked out. Interested in seeing the actual stocks that make up the Bespoke Model Stock Portfolio? Sign up for a 5-day free trial to our Bespoke Premium service and gain access now.

Bespoke’s Model Stock Portfolio: 3/13/15

The Bespoke Model Portfolio gained again this week and is now up 8.7{0e584ec94eaa64d073763ee1dc286a1f4d0f941424b1448bbfd01af7d90f9475} year-to-date. To gain access to the portfolio, simply sign up for a 5-day free trial to one of our subscription services. You’ll find it at the end of our just-published Bespoke Report newsletter. You can sign up today using our “End of Winter” special to get a 10{0e584ec94eaa64d073763ee1dc286a1f4d0f941424b1448bbfd01af7d90f9475}+ discount on your new membership. Simply enter “spring” in the coupon code section of our Subscribe page.

S&P 500 Higher or Lower from Here?

The market managed a nice gain to end the week and is now up solidly in April. So which way will the market head from here? Please take part in our Bespoke Market Poll below by letting us know whether you think the S&P 500 will be higher or lower one month from now. We’ll report back with the results on Monday before the open. Have a great weekend! On a side note, be sure to sign up for a 5-day free trial to get an inside look at our member offerings. If you like the content we provide on Twitter @bespokeinvest and at our free Think B.I….

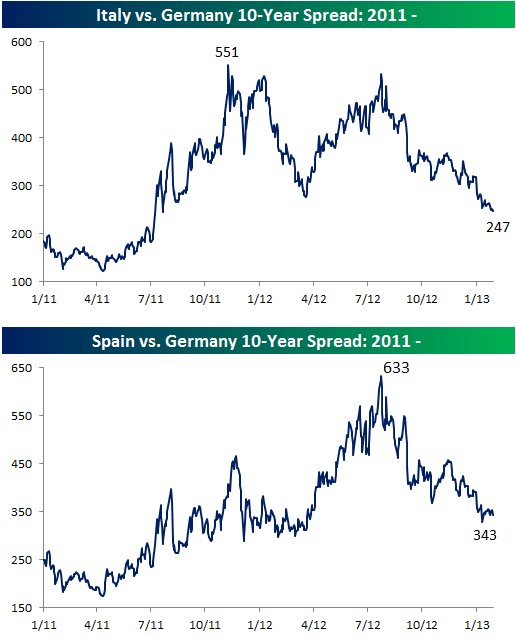

Euro Area Spreads Near 52-Week Lows

Spreads on the debt of sovereign European countries have been falling like a rock recently, especially in Italy and Spain. Current spreads on the 10-year sovereign debt of Italy are trading at just 247 bps above 10-year German paper. This is the lowest level since the Summer of 2011, and it’s less than half of the peak level that spreads reached in late 2011. Spreads on sovereign debt in Spain are down by a similar amount. After peaking at a level of 633 bps last Summer, spreads are down by nearly 300 bps and near their lowest levels since last Spring. …